The Amish, known for their simple living, plain dress, and reluctance to adopt modern technology, are often perceived as being separate from mainstream society. This distinct way of life raises questions about their participation in broader societal obligations, such as paying taxes. Understanding their tax responsibilities provides insight into how the Amish balance their religious convictions with legal requirements.

Key Takeaways

- The Amish community pays standard income and property taxes, contributing to local and national infrastructure like any other U.S. citizen.

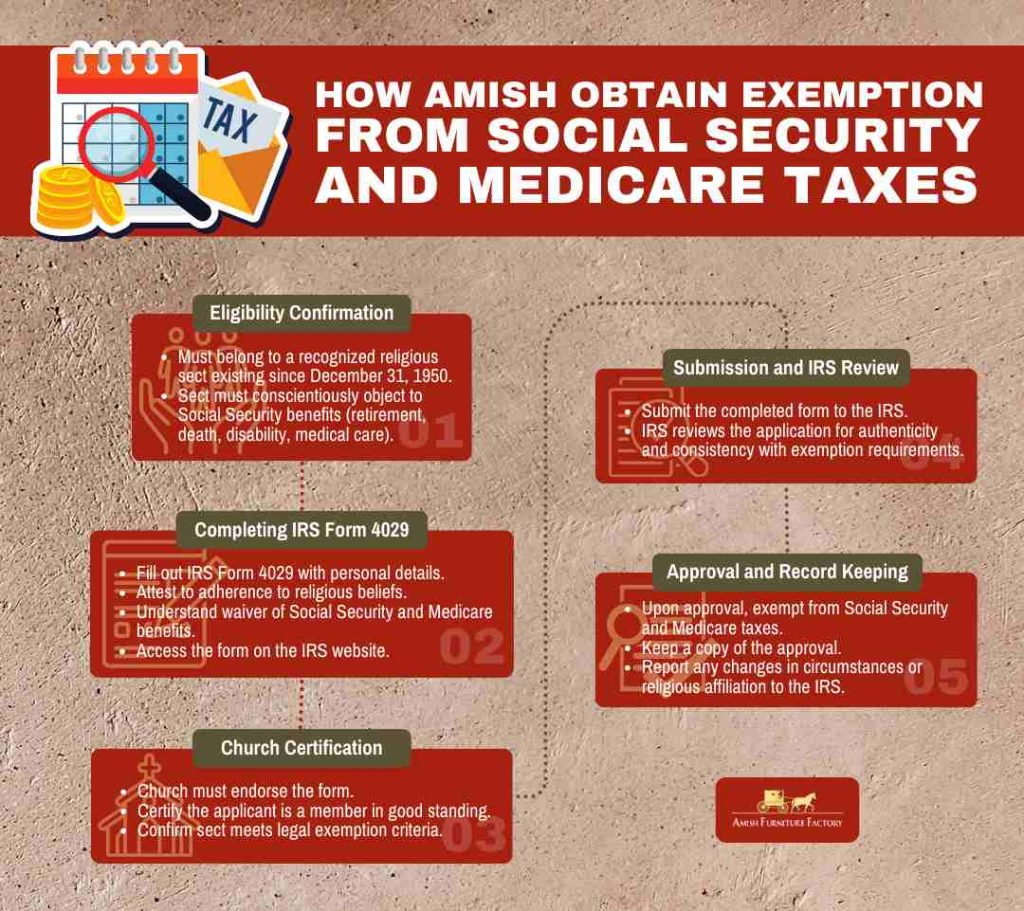

- Following a formal application process with the IRS, the Amish are exempt from paying Social Security and Medicare taxes due to their religious beliefs in self-reliance and community support.

- The Amish use paper forms for tax filing and maintain handwritten records, avoiding modern electronic methods due to their lifestyle choices.

- Despite their separateness from many modern societal practices, the Amish still uphold a strong sense of civic duty by paying applicable taxes and contributing to the community infrastructure.

Here’s a closer look at how the Amish handle their tax responsibilities, uncovering the taxes they pay, the ones they don’t, and the reasons behind these choices.

What are the General Tax Obligations for U.S. Citizens?

Learning about U.S. taxes can be as intricate as the fine details carved into Amish Furniture. Just as each piece tells a story of tradition and craftsmanship, every tax has its role in building and maintaining our society. Knowing these obligations is essential to fulfilling civic duties for every citizen, including our Amish neighbors.

In the United States, whether you’re a corporate man in a city or a farmer in the Amish countryside, there are several types of taxes that most residents are obligated to pay:

- Income Tax is the tax most people are familiar with. It’s levied on money earned from work or investments. For the typical U.S. citizen, filing an annual income tax return with the IRS is as regular as the changing seasons.

- Property Tax: You must pay property taxes if you own a home in a suburban neighborhood or a large farm like many in Amish country. These taxes are used locally to fund public schools, roads, police, and other community infrastructure.

- Sales Tax: Almost every purchase involves sales tax, from a new bedroom set to everyday groceries. Retailers collect this tax and pass it on to state and local governments.

- Estate and Gift Taxes: These taxes apply when you give a substantial gift or leave an estate to someone after you pass away. They are a tax on transferring wealth, and while they don’t affect everyone, many of us need to consider them in our financial planning.

- Excise Taxes: Often hidden in the price of goods like gasoline, alcohol, and tobacco, excise taxes are paid when purchases are made on specific goods.

What are the Types of Taxes Paid by the Amish?

The Amish communities still have to navigate the complexities of taxation. Here’s a look at the types of taxes the Amish are responsible for:

1. Income Taxes

Despite common misconceptions, the Amish pay federal and state income taxes. Their earnings from farming, crafting, and other ventures are subject to the same tax rates as those of anyone else in their income brackets.

Their approach to reporting income is straightforward: they report earnings from these sources like other U.S. citizens.

Here’s how they typically handle their income reporting:

- Manual Record Keeping: Amish individuals and businesses often rely on handwritten records to track all transactions and financial events. Due to their religious beliefs that limit the use of modern technology, such as computers and electronic systems, they maintain physical ledgers.

- Use of Third-Party Accountants: Recognizing the complexity of tax laws and the need to comply with federal and state regulations, Amish often seek the assistance of non-Amish accountants to prepare their tax returns. These accountants take the physical records maintained by the Amish and translate them into the standard forms required by the IRS.

- Filing Paper Returns: The Amish typically file their tax returns using paper forms, which is consistent with avoiding electronic transactions.

- Acquiring Tax Forms: Amish taxpayers do not use electronic means to access or fill out their tax forms. Instead, they often collect free paper tax forms from local libraries and city halls or request them by mail from the IRS.

- Payment Methods: The Amish typically prefer paying their taxes in cash. This preference aligns with their general avoidance of modern financial systems like online banking or credit card use.

2. Property Taxes

Property taxes are another area where the Amish contribute, as do their non-Amish neighbors. Owning extensive farmland and property, Amish landowners pay taxes that support local infrastructure, including roads and public utilities, which are essential even in their largely self-sufficient communities.

However, they do not benefit from all services funded by these taxes, such as public schools, since Amish children typically attend private Amish schools. Yet, their commitment to community and civic responsibility ensures they do so without contention.

3. Sales and Excise Taxes

Regarding sales and excise taxes, the Amish are like any other consumer in the states where they reside. Whether purchasing materials for their trades, groceries for their homes, or supplies for their farms, sales taxes are a part of their transactions.

Excise taxes, often included in the cost of specific goods like fuel and certain utilities, are also paid by the Amish when such purchases are made. However, because of their lifestyle choices, such as rarely using alcohol or tobacco, they naturally avoid excise taxes on these products.

4. Other Taxes

In addition to those three taxes, the Amish community also pay for the following:

Capital Gains Tax is a tax on the profit from the sale of property or investments. This tax is relevant if Amish individuals sell property or investments at a profit. However, this scenario is less common as the Amish typically invest in their community or hold property long-term.

Estate Tax is applied to an individual’s estate after their death. This tax applies if Amish individuals leave behind significant assets. However, due to the Amish community’s support structures and lifestyle, large taxable estates are uncommon.

Gift Tax is imposed on gifts that exceed certain value thresholds. This tax is relevant if an Amish person gives a gift valued above the annual or lifetime exclusion limit. Given their lifestyle of modesty and communal sharing, such instances are rare.

What Taxes Are the Amish Exempt From?

The Amish community contributes to many common taxes but is exempt from several others due to their unique beliefs and practices. Here are some of the taxes from which the Amish are typically exempt:

Social Security Taxes

One of the most significant exemptions for the Amish relates to Social Security taxes. The Amish do not participate in the Social Security system, including Medicare. This exemption is rooted in their belief against insurance, as they rely on their community for support in times of need, such as old age or disability, rather than on government aid.

To obtain this exemption, Amish individuals usually follow these steps:

Gas Tax

While not universally exempt from gas taxes, the Amish lifestyle naturally results in lower gas tax payments. Many Amish do not own motor vehicles and prefer horse-drawn carriages for transportation, leading to minimal gasoline consumption compared to the average American. Consequently, they often do not pay the gas taxes typically associated with fuel purchases. However, this does not apply if they use gasoline for agricultural purposes or hire motor vehicles for specific needs.

Sin Taxes

Sin taxes are levied on products like alcohol, tobacco, and gambling activities—items the Amish typically avoid due to their religious beliefs. By not consuming these products, the Amish naturally avoid the associated sin taxes. This is not a formal tax exemption but rather a result of their commitment to living according to their ethical and religious standards.

Unemployment and Workers’ Compensation

Similar to their stance on Social Security, many Amish are exempt from unemployment taxes and workers’ compensation due to their community support structures. The Amish community provides internal support to members in times of need, such as unemployment or injury.

However, the situation differs when Amish employers hire non-Amish workers. In these cases, state laws require compliance with standard employment practices, including paying unemployment taxes and providing workers’ compensation. This legal obligation ensures that all workers receive legal protection regardless of their employer’s religious affiliations.

Amish and Mennonite Tax Exemptions: A Comparative Analysis

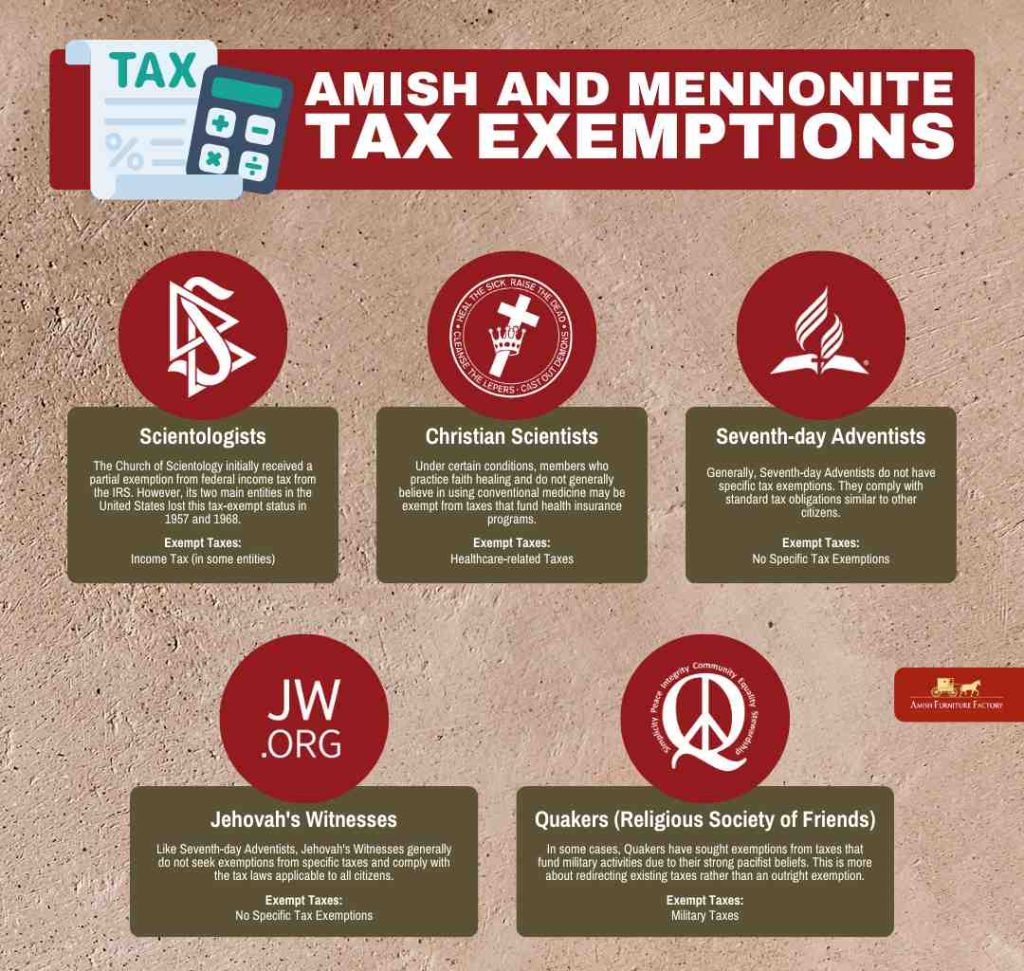

The Amish and the Mennonites stem from the Anabaptist tradition, which historically emphasizes separation from state affairs and a solid community-oriented way of life. However, their approaches to government interaction, especially regarding taxes, show similarities and notable differences.

Social Security and Medicare Taxes

The Amish are exempt from paying Social Security and Medicare taxes due to their religious beliefs that prioritize community support over governmental aid. This exemption reflects their commitment to mutual assistance within their communities, where they collectively ensure the welfare of their members without relying on external insurance or benefits.

Similarly, conservative Mennonite groups might also seek exemptions from Social Security and Medicare taxes. However, not all Mennonite communities choose to apply for these exemptions. The degree of integration into and acceptance of governmental programs can vary significantly among Mennonite congregations, with some choosing to participate fully in government insurance programs. This variation reflects the diverse practices and beliefs within Mennonite communities regarding government aid and self-reliance.

Property and Income Taxes

Amish individuals generally pay property and income taxes. Their exemption from certain taxes does not extend to these areas, as these taxes are seen as necessary contributions to local and national infrastructures. This aligns with their ethical guidelines for being good neighbors and citizens.

Similarly, Mennonites typically pay property and income taxes. They view these obligations as a civic duty supporting the community. There is less variance among different Mennonite groups regarding property and income taxes compared to their views on Social Security and Medicare, with most groups uniformly accepting these tax responsibilities.

Cultural and Community Context

The Amish maintain a high level of separation from the modern world, which significantly influences their tax practices. Their exemptions are closely tied to their lifestyle choices, as they eschew modern conveniences and technologies, aligning with their commitment to simplicity and self-reliance.

In contrast, Mennonites often exhibit a greater degree of integration into society. While they share many core beliefs with the Amish regarding community and simplicity, their engagement with modern technology and society varies. This leads to a more diversified approach to tax exemptions and contributions, reflecting their broader acceptance of modern conveniences and a less uniform stance on separation from mainstream societal structures.

Implications of Amish Tax Practices

The Amish approach to tax obligations highlights the balance between religious freedom and tax policy in the U.S. Their exemption from Social Security taxes underscores respect for religious beliefs under federal law, accommodating diverse practices as protected by the First Amendment.

However, such exemptions challenge the uniform application of tax laws and raise questions about fairness and the distribution of the tax burden. Policymakers must find a balance that respects religious practices while ensuring equitable tax responsibilities.

State interests focus on collecting revenue to fund public services like Social Security and Medicare. Religious exemptions, while crucial for upholding freedom of religion, allow groups like the Amish to maintain their beliefs and mutual aid systems. Balancing these interests involves recognizing the contributions of religious communities through other taxes, ensuring both the sustainability of public services and the protection of religious freedom.

Reflecting on Amish Tax Practices: Balancing Tradition and Civic Duty

The Amish demonstrate a unique approach to tax responsibilities, balancing their religious beliefs with civic duties. They contribute through income and property taxes while being exempt from Social Security and Medicare taxes. This dual approach highlights their commitment to self-reliance and community support, ensuring they remain engaged in broader societal obligations. Understanding these practices offers valuable insights into how religious communities navigate their roles within the larger framework of national and local governance.

FAQs

Do Amish people pay mortgages?

Amish people pay mortgages if they need to finance a property purchase. Like anyone else, they engage in mortgages when necessary, though they typically prefer to avoid debt, aiming to pay outright with cash if possible due to their values of financial independence and simplicity.

Do Amish People Pay Taxes in Canada?

Amish in Canada are subject to the same tax obligations as other Canadian residents, which include paying federal and provincial taxes. They do not receive any special exemptions from taxes based solely on their religious practices, so they are responsible for income taxes, property taxes, and other applicable taxes, just like their non-Amish neighbors.

How Do Amish Pay Property Taxes?

Amish property owners pay their taxes much like other property owners. They settle their property tax bills using traditional payment methods, such as cash or checks.